By DAVID WEISBACH

Review of CLIMATE CASINO: Risk, Uncertainty, and Economics for a Warming World, by William Nordhaus

Yale University Press, 2013

View GAMBLING ON THE CLIMATE .pdf

There is a great need for a better understanding of climate change. Public statements range from denial and indifference to outright panic and suggestions of policies that are physically impossible or enormously costly. William Nordhaus’s Climate Casino provides an antidote to both. Written for the public, it provides a sensible walk through the science and the economics of climate change, debunking claims of the deniers, the indifferent, and the panicking. It makes a strong case for finding a balance between the costs and benefits of emissions reductions, and finding effective policies. Nordhaus has provided a tremendous service in writing this book. If our policies were as sensible as his recommendations, we would be in a far better place.

To study the effects of climate change, and of policies to combat climate change, analysts often use computational models known as “integrated assessment models” or in the jargon of the profession, IAMs. IAMs start with a model of the economy. The modeled economy produces goods and services that people consume but in doing so emit greenhouse gases. IAMs feed these emissions into a model of the climate, which estimates the resulting climate change. This climate change in turn harms the economy, completing the circle. IAMs are solved at each time step and run forward for several hundred years to produce a scenario of the future.

IAMs have a large number of flaws. Data is missing. Even the best economic models are crude. They do not properly consider the impacts of climate change. The flaws may be inevitable. The task they are assigned – estimating the impacts of climate change over hundreds of years and in conditions far outside modern experience – is not an easy one. For all their flaws, however, IAMs may be the best tool we have. As Nordhaus describes them, they are a fuzzy telescope. They provide at best a hazy glimpse of possible futures, which is better than no glimpse at all.

Nordhaus is author of the most well-known IAM of climate change, a model known as DICE (an acronym with no real meaning). It is a simple model. It treats the entire world as a single region and represents all global economic activity through just a handful of equations.

DICE was one of the first IAMs to consider climate change. It is by far the most transparent, in part because it is simple and in part because Nordhaus releases all of his computer code, unlike most other modeling groups. It is the most widely used integrated assessment model. It has been used by the United States government to set regulatory policies, and it has been used in hundreds of published papers. And it is the basis of this book.

The book is largely organized around the structure of DICE. DICE is circular in the sense that the economy in the model produces emissions, which feed into a climate model, producing temperature increases, which hurt the economy, which produces emissions, and so forth. Nordhaus has chapters on each of these steps. Anywhere you start, there is a prior component feeding into it, so Nordhaus’s only choice is to dig in somewhere. He makes the sensible choice to start with the science: how emissions lead to climate change.

The basic ideas are well-known but worth reviewing. Carbon dioxide (CO2) is the star player. Although its fraction of the atmosphere is tiny (0.04% or 400 parts per million), it absorbs infrared radiation, which the Earth radiates outward due to the incoming energy from the Sun. CO2 acts like a planetary blanket, warming the Earth and making life possible. More CO2 is like a thicker blanket, causing the Earth to be warmer.

The concentration of CO2 and the resulting temperatures have varied over the history of the Earth due to natural variation such as volcanic eruptions, irregularities in the Earth’s orbit and feedback effects which amplify changes of these sorts. We have been in a relatively cool period for some time, and for the last 10,000 years, during the rise of civilization and agriculture, a highly stable period.

CO2 stays in the atmosphere for very long periods of time. About half of what we emit is taken up immediately by the ocean. About a quarter is reabsorbed over several thousand years and the last quarter remains beyond that time. For policy purposes, we can think of emissions as remaining effectively forever, with no easy way to eliminate them.

We would very much like to know how much warming we will get as we increase the concentrations of CO2 in the atmosphere. Unfortunately, there is a great deal of uncertainty here. Feedback effects, such as cloud formation and changes in the reflectivity of the Earth due to ice melting, are hard to model. We do not know whether we face mild or catastrophic climate change in the next century or two. This basic and irreducible uncertainty is a key problem in setting policy.

CO2 also plays a central role in our economy because it is the basis of our energy system. Through photosynthesis, plants use sunlight to combine atmospheric CO2 with water to produce organic molecules such as sugars. The solar energy is stored in the chemical bonds. Plants and animals (when they eat plants or eat other animals who eat plants) can use this energy to fuel their activities by burning the molecules, releasing the energy in the chemical bonds. Not all of the organic molecules created from photosynthesis are consumed right away. When plants die, some of their organic matter accumulates, creating fossil fuels.

The industrial revolution largely consisted of finding ways to convert the energy stored in this buried organic matter into motion. We take the organic matter that is stored underground and burn it, releasing the energy created during the long-ago photosynthesis. We use the energy to produce all sorts of useful things. As a byproduct, we release CO2 into the atmosphere which causes climate change. Transforming energy has allowed wealth in developed countries to increase 30-fold over the last 200 years. Roughly 85% of our energy comes from fossil fuels, which are by far the cheapest and most reliable source of energy available.

A basic task of IAMs is to predict what emissions will be in the future. If emissions stopped today, climate change would not be much of a problem. Future emissions depend on economic growth, how much energy we use to produce the growth, and how much carbon we use to produce the energy. None of these are known. All we can do us guess. Assuming historical patterns will continue is one possible guess, but there is no guarantee. China and India have been growing rapidly and their emissions have skyrocketed, but will their growth continue? We don’t know.

Nordhaus provides detail on his estimates. He predicts strong continued growth and also a strong reduction in the carbon-intensity of the economy. He makes this latter estimate based on the global trend in emissions per unit of GDP. Emissions per unit of GDP has been declining for some time but not as fast as GDP has been going up, resulting in a net increase in emissions, which he predicts will continue.

One of the issues for laymen in interpreting model results is understanding what assumptions have gone into the model. These are often complex, and subtle changes can change the modeled outcomes. Nordhaus, to his credit, is completely open about the basis for his assumptions. But what are we to make of his assumption of rapidly declining carbon intensity of GDP?

There is, of course great uncertainty, but we do know some things. The most important, and one that I wished Nordhaus had emphasized much more, is the tight connection between energy and growth. It is difficult to overstate our reliance on energy. Energy use is so pervasive and the energy supply is so reliable that it becomes almost invisible. Essentially everything we do uses energy, from just sitting in your home and reading (the construction of your home required energy, and heating and cooling it uses energy), to moving about (almost all of our transportation relies on petroleum), to consuming products (which require energy to be made). It is the invisible basis of modern life.

If you graph energy use against wealth, you will find that no country has ever become wealthy without massive energy use. No matter how green, no matter how efficient, every country has followed the same path: as it gets richer it uses more energy. Moreover, energy use goes up with wealth at almost exactly the same rate in every country. It is as close to an iron law as I have seen in economics. We cannot be wealthy without energy, and if you tell me a country’s wealth, I can tell you its energy use with great accuracy.

Some hypothesize that as wealthy countries become more service oriented, energy use per dollar of GDP will go down, decoupling energy use from growth. Even if true, it will only flatten out the relationship a bit. Energy use will still go up as we grow. And as developing countries grow, their energy use will go up rapidly. Even if we believe in decoupling, most developing countries are nowhere near the wealth level at which this decoupling might occur. If we think the global economy will continue to grow, we face a future of increasing energy demands. This is consistent with Nordhaus’s assumptions in DICE, but its centrality cannot be overemphasized.

One way to frame the problem of climate change is that we need 21st century energy use with 19th century (or earlier) emissions. Modern Americans use about 10,000 watts per person, almost all of which comes from fossil fuels. That 10,000 watts per person creates our modern lifestyle. We need to find a way to produce that energy using carbon-free sources, and so does the rest of the world. Without a carbon-free source of energy, we will face the choice of being hot or being poor, or possibly both.

The next section, and to some extent the core, of the book is a series of chapters on the impacts of climate change. We only care about climate change because of impacts. These chapters provide a survey of what we know.

Nordhaus here takes the stance that we must rely on evidence to determine the likely impacts. He usefully divides impacts into what he calls “managed systems” and “unmanaged” systems.” Managed systems are systems like agricultural or health care. They are parts of the economy. Unmanaged systems are things like species extinctions, sea level rise, and storms. They interact with the economy but largely function on their own. His key claim is that the most heavily impacted managed systems are a small part of the economy. Agriculture, for example, makes up about 1% of our GDP. Even if the impacts in those sectors is large, the costs overall are modest. If we double our expenditures on agriculture to maintain our food supply, the additional costs are another 1% of GDP, not insignificant but not overwhelming.

The impacts on non-managed systems may be larger but there is little or no data to support estimates. Moreover, growth mitigates harms: if we are richer we are better able to bear losses. Non-managed systems are not easy to model, and it does not appear that DICE attempts to directly include them. Nordhaus says that because of the risks in unmanaged systems, we should be willing to spend more to reduce climate change than otherwise (through what is a called a risk premium, the amount we are willing to pay to avoid or accept a risky outcome) but he does not say what the premium should be or whether DICE includes such a premium.

The differing points of view between scientists who study climate change and economists like Nordhaus, are quite startling. Take farming as an example. The Proceedings of the National Academy of Sciences published a review paper in March of 2014 by 27 scientists estimating the impact of climate change on farm production. They used 10 global hydrological models and six global gridded crop models to estimate water loss due to climate change and the ability to substitute rain-fed and irrigated farming to offset that loss. The models were quite detailed and included information on water supply, run-off, rainfall, crop yields, and other factors for a vast number of locations around the globe. These scientists estimated that even using irrigation, we will see an 8-24% reduction in production of maize, soybeans, wheat and rice if we include carbon fertilization (more carbon in the air might improve photosynthesis) and 24-43% otherwise. In English, a large number of scientists appear to be telling us that we could see massive reductions in key staple crops later this century.

Nordhaus does not address this particular study (it was published after he wrote his book) but his basic claim is that we would not see these sorts of reductions. To avoid disruption of the food supply, people would invest more in farming. We would convert unused land to agriculture, switch the location of where we farm, develope new plant varieties, pipe in water, and so forth, to avoid these losses. The costs of these sorts of adjustments would be less than the harms from the mass starvation the scientists are predicting. And even if these adjustments mean that farming costs increase dramatically, the extra expense would be modest because we spend so little on farming as it is. A large multiple of a small number is small. The scientific study is static. It does not take into account how economies actually work—how people respond to changes in the environment and the market. Nordhaus repeatedly hammers home this point in these chapters.

I am not sure where I come out on this. Agriculture is not like baseball trading cards or Beanie Babies, where we can do without. Hearing that we face a potential loss of 20-40% of our food supply is sobering even if we might be able to replace the losses with a more expensive source of supply. The disruption can be large, particularly if the new sources are in different locations than the old sources or if the loss is rapid. And what if replacing it is extremely expensive? Imagine a blight that kills a large portion of pollinating insects and a simultaneous drought in most productive agricultural areas. There might be no quick easy replacement. Even if Nordhaus’s reading of the evidence is the most likely case, what are we to do about the potential bad cases? How much insurance should we buy?

Norhaus’s arguments apply to modest temperature increases, in the range of 2° to 3°C. Suppose we accept his estimates for this range of temperatures. Even so, his estimates for harms from large temperature increases, in the 5° to 6° range, are far more troubling. His stance, that we must be scientists and rely on data on how economies actually operate, breaks down here. There are no data that tell us anything about how we would function with 6° of warming. Nobody has ever lived in such an environment or through such a rapid environmental change. Economic models are based on economies and conditions we have observed. They may contain little information outside of their domain.

The only information we have is the paleoclimate record, where we have seen extreme temperature changes over the course of the Earth’s history. The results are not pretty. The living conditions with a 6° temperature change would be completely different from what we face now. Temperatures 6° cooler led to the last ice age. The last time the Earth was 6° warmer, lizards and ferns lived in Alaska. Temperature changes of this sort are thought to be behind a number of the large-scale extinctions in the Earth’s history. And the transitions in the past happened on a vastly slower timescale than what we are facing. When you talk to scientists to understand why they are so scared of climate change, it is the paleoclimate record that keeps them up at night.

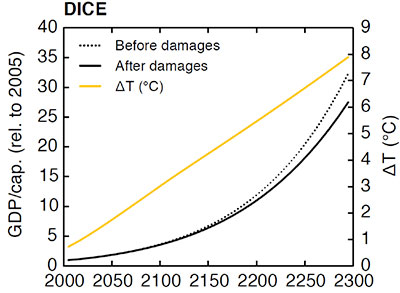

Nordhaus’s estimates do not take account of these sorts of changes to our environment. The figure below, from a recent paper, shows the results from two runs of DICE, one with and one without climate change. Nordhaus estimates that in the year 2300, without climate change, we will be about 31 times richer than today. With climate change, temperatures will go up by well over 7°. Instead of 31 times richer, we will merely be 26 times richer. Americans today earn about $50,000 on average. Nordhaus is saying that in 300 years without climate change we would be earning more than $1.5 million on average, but with climate change, we will only be earning $1.3 million. These are not serious impacts, even at temperatures scientists tell us will be catastrophic.

The scientists could be wrong. We don’t know what the world would be like with 7° of warming and 300 years of technological development, but Nordhaus’s result strikes me as implausible. Something has to be wrong with a model that predicts this, not just as a possibility, but as the central case. And without evidence to support such a prediction. Nordhaus’s objective, “just the facts ma’am” approach breaks down once we consider higher temperatures. We are at the point of conjecture, not data. The conjecture embedded in DICE would not be the conjecture of most scientists.

Worse, the assumption of what happens at extreme temperatures – again, there is no data here so it is just an assumption – drives the model results. We can see this by changing the assumption and running the model to see what happens. Climate impacts in DICE are presented by a simple function: harms go up with the square of temperature increases. It is easy to change this to test alternatives.

To see the possibilities, a team of us at the University of Chicago built a web-based version of DICE which we call webDICE (shameless plug). You can find it at http://webDICE.rdcep.org. You can run the model and see graphical output just by clicking on buttons in a browser. You can also change any of the model inputs to reflect views different from Nordhaus’. One of the things you can change is how climate change affects people and the economy, particularly at high temperatures.

There are any number of possible replacements for Nordhaus’s quadratic damage function. Martin Weitzman, an economist at Harvard, has suggested replacing the damage function in DICE with one that has a tipping point: at some temperature, the harms become dramatically worse.

Weitzman’s tipping point function is an option in the webDICE, so you can try it to see for yourself what happens. There is a slight technical issue which is that DICE uses a highly simplified model of the climate which is accurate only for about 200 years. With the larger harms implied by Weitzman’s tipping point function, the inaccuracies after 200 years turn out to matter (for reasons relating to the discount rate, which goes down when harms get large; with a lower discount rate future periods matter more and it is important to have a climate model that is accurate over longer time periods). For this reason, webDICE includes an option to run a more accurate climate model. To run the Weitzman tipping point function, choose the tipping point damages in the damages tab and choose the BEAM carbon cycle in the climate tab, which gives you a more accurate climate model.

What happens? Instead of continuing to grow, the economy begins to shrink once we hit about 5° of warming. After 300 years we are worse off than today instead of 26 times richer than today.

An alternative approach is to change how climate change affects the economy. In DICE, climate change causes output to disappear. The economy produces, say $100 trillion of goods and services. If the harms from climate change are 5%, people can only consume $95 trillion. Growth in this formulation is largely unaffected, so if the baseline growth rate is 2%, next year’s consumption goes up by 2% from $95 trillion, and 2% the year after that, and so forth. Over the long run, exponential growth dominates even massive annual losses, which is why Nordhaus predicts such a rosy future even with considerable climate change.

What if climate change slows down the growth rate of the economy? This might occur for any number of reasons. For example, we might be spending so much on new technology to reduce the impacts that we spend less on normal growth-producing technologies. Or existing technologies might not work as well in a changed climate.

Suppose we say that Nordhaus is 95% correct, which is generous given that we have no information about the matter and that his core case seems implausible. But suppose we keep 95% of his formulation. Let the other 5% of harms reduce the productivity of the economy, which is the key factor producing growth.

The result is catastrophic. The economy eventually undergoes a massive collapse. (Try this in webDICE: choose BEAM, as above, and for damages, choose “Fraction to Productivity.”) With 5% of the harms reducing productivity, the economy begins to shrink in the first 200 years and at the end of 600 years (not shown in the webDICE graph but computed by the model and visible if you download the CSV file), the economy is near subsistence.

Of course we don’t know what will happen. I’m not claiming that Weitzman’s tipping point or the reduction in productivity formulation is correct, and that we are headed back to a Flintstones economy. At a minimum, however, we should consider the full range of possibilities and not restrict ourselves to an assumption that climate change does not matter when temperatures increase enough to cause a massive transformation in our environment.

The hard thing about climate change is that we must decide what to do even though we don’t know what climate change will bring. If we wait to find out, it will be too late: you can’t take the carbon back once it is in the atmosphere. It stays there for hundreds or thousands of years and we will live with the consequences, good or bad. There are no mulligans. Nordhaus’s book is called “The Climate Casino” but the analogy is inapt. In a casino you know the odds. But for climate change, particularly with extreme temperature increases, we don’t know and cannot know. We have to decide how much we want to spend to avoid the potential bad cases without knowing what those cases are.

Notwithstanding these criticisms, Nordhaus’s recommendations about what to do, found in the next section of the book, are entirely sensible. Nordhaus has long been an advocate for a price on emissions of CO2. The book has a useful discussion of the two ways of imposing a price, a cap and trade system and a tax. A cap and trade system imposes a price via the requirement that you purchase a permit to be able to pollute. If the price of permits were, say, $25 per ton of CO2, you would not pollute if the costs of reducing your pollution were less than $25. If the costs were more than $25, you could purchase a permit instead of reducing emissions. If the tax rate were $25, you would also reduce emissions if the costs were below $25 so as to save taxes, and if the costs were more, you would pay the tax. The two are basically the same. While there are some subtle differences, and Nordhaus prefers a tax (as do I), he sensibly says that the differences are swamped by the benefit of having a price of either sort. He would take either (as would I).

How can Nordhaus’s policies be sensible if he so vastly underestimates the harms at extreme temperatures? His proposed tax rate is lower and allowable temperature increase higher than what we would see in a more robust model. A better tax rate might be double, triple, or even more, of what he proposes. The tax rate would also increase faster. But what he proposes is so far beyond where we are now and where we seem to be headed that arguing about the differences seems like nitpicking, letting the perfect be the enemy of the good.

A second key point that Nordhaus makes is that the price on CO2 must be global. We cannot stabilize the atmosphere and limit climate change unless all major emitters, China and India included, reduce and eventually eliminate emissions of greenhouse gases. Proposals like the Kyoto Protocol (the only binding treaty to reduce emissions) that leave out developing nations, cannot stop climate change or even limit it to tolerable levels. To be effective, the treaty negotiated in Paris next December has to include all major emitters.

Nordhaus shows this with DICE, but unfortunately DICE is not well-suited to the task. DICE is a global model. It does not include countries, nor does it track emissions to different regions. We can hack it to make it behave as if only part of the world agreed to reduce emissions but it is not really a good way of studying the problem. Instead, we need a model that includes individual countries. Nordhaus actually has such a model, a regional version of DICE called RICE. I suspect that his conclusions regarding participation come from RICE, but the presentation in the book seems to be from DICE, and, therefore, is less convincing than it should be. This is a particular shame because the need for global participation is very important.

A novel aspect of Nordhaus’s proposal (I’ve seen it before only in a very recent article by Martin Weitzman) is that he would have a global treaty that sets a price on emissions. The approach taken in negotiations so far is to set emissions caps for each country. This requires the treaty to determine how much of a limited good – total emissions – each country gets, which means that countries are bargaining over a fixed pie. Nordhaus argues that it would be easier for countries to agree to a price. The treaty negotiation would be over a single number. Nations would agree that they will impose, say, a $25 or $50 price on carbon dioxide. They would not have to agree to a specific allocation for each country.

While there is much to recommend this approach, there are real problems too. The most serious issue would be enforcement. If countries agree to emissions caps, we can readily detect violations through existing reporting mechanisms. If countries agree to a price, there would be no easy way to tell if they have actually imposed the price. They might have a carbon tax, which would be easy to observe, so they could claim that they are complied with their obligations. But suppose that at the same time they offer incentives in their income tax system for fossil fuel extraction? Or they lease government-owned land at below market prices to the fossil fuel industry (as the US does)? Or build roads to remote locations where there happens to be fossil fuel deposits. Or their universities offer fantastic training in fossil fuel engineering but not in clean energy engineering? The WTO currently faces this problem with determining when a country is engaging in an illegal subsidy. The EU faces it when determining whether a country has engaged in illegal state aid. It is sort of, maybe possible to figure this stuff out, but it is not easy.

One of the central problems with a climate treaty is free riding. A treaty might make all countries better off by reducing climate change, but each country would be even better off if the other countries reduced emissions while it did not. How can we prevent countries from free-riding? One method that has been proposed is “border adjustments.” Countries would tax all imports of goods from countries that do not have a carbon price. The tax would equal the tax that would have been imposed had that exporting country imposed its own carbon price.

Nordhaus wisely points out that this may not work. It is tremendously difficult to do because we have to calculate the “as if” price which means we have to know the production technologies and energy sources for goods produced in other countries. And for most countries, most emissions are due to production of goods consumed within the country. Therefore, border taxes may not provide much of an incentive. Nordhaus instead prefers an explicitly punitive tariff. While this might require a change to our trade rules and will likely scare those devoted to free trade, the idea is worth serious thought. It does not, however, overcome the free-riding problem because countries can also free ride by refraining from imposing tariffs.

There is much else useful in the book. It includes a nice discussion of the possibility of a climate change tipping point using a ball in a bowl to illustrate. Nordhaus has no truck for climate deniers and devotes several chapters to debunking their claims. He suggests research into geoengineering along the lines roughly similar to the National Academy recommendation that came out this year. He considers regulatory policies as alternatives to prices.

There are two further topics where his views may generate controversy. He strongly supports the use of cost-benefit analysis and he supports the use of a discount rate that reflects market rates of interest (the discount rate is important in IAMs because it determines how we weight the present and the future). I agree with Nordhaus’s views on these issues but many do not. The defenses in the relevant chapters are brief and are unlikely to convince detractors, and I would have liked to see more. (To be fair, he has written extensively on discounting, but generally in more technical forums.)

Nordhaus does not disappoint in this book. He covers a large of territory in an accessible and clear manner. His recommendations are sensible. The question is how to get from where we are to the policies he recommends. That would require another book.

DAVID WEISBACH is Walter J. Blum Professor of Law and Senior Fellow, the Computation Institute of the University of Chicago and Argonne National Laboratory. He is the author of two books, "Climate Change Justice (Princeton University Press, 2010) and Tax Treatment of Contingent Debt (Practicing Law Institute, 2000).